Kiymaz, Halil

Loading...

Profile URL

Name Variants

Kiymaz, Halil

H.,Kiymaz

H. Kiymaz

Halil, Kiymaz

Kiymaz, Halil

H.,Kiymaz

H. Kiymaz

Halil, Kiymaz

Kiymaza, Halil

H.,Kiymaz

H. Kiymaz

Halil, Kiymaz

Kiymaz, Halil

H.,Kiymaz

H. Kiymaz

Halil, Kiymaz

Kiymaza, Halil

Job Title

Prof. Dr.

Email Address

Halıl.kı[email protected]

Main Affiliation

Business Administration

Status

Former Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

15

LIFE ON LAND

0

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

0

Research Products

14

LIFE BELOW WATER

0

Research Products

6

CLEAN WATER AND SANITATION

0

Research Products

3

GOOD HEALTH AND WELL-BEING

0

Research Products

17

PARTNERSHIPS FOR THE GOALS

0

Research Products

4

QUALITY EDUCATION

0

Research Products

2

ZERO HUNGER

0

Research Products

10

REDUCED INEQUALITIES

0

Research Products

7

AFFORDABLE AND CLEAN ENERGY

0

Research Products

13

CLIMATE ACTION

0

Research Products

1

NO POVERTY

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

0

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

0

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

1

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

0

Research Products

5

GENDER EQUALITY

0

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

2

Articles

2

Views / Downloads

14/244

Supervised MSc Theses

0

Supervised PhD Theses

0

WoS Citation Count

24

Scopus Citation Count

27

WoS h-index

2

Scopus h-index

2

Patents

0

Projects

0

WoS Citations per Publication

12.00

Scopus Citations per Publication

13.50

Open Access Source

0

Supervised Theses

0

| Journal | Count |

|---|---|

| Journal of Behavioral and Experimental Finance | 1 |

| Journal of Financial Counseling and Planning | 1 |

Current Page: 1 / 1

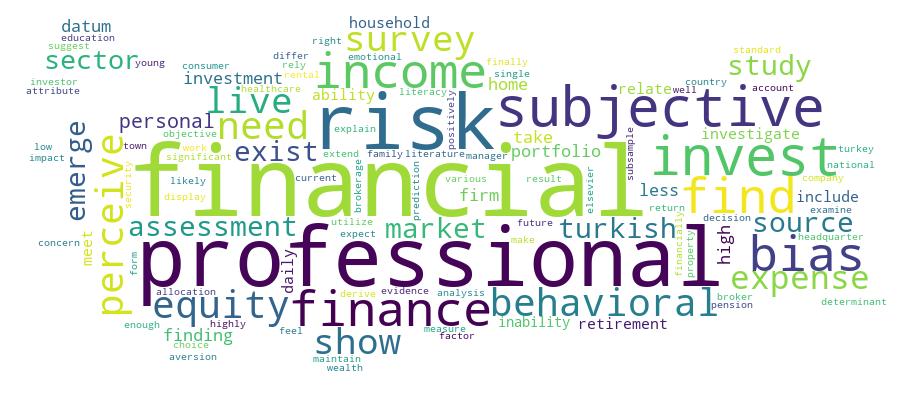

Competency Cloud