Bilge, Ayşe Hümeyra

Loading...

Profile URL

Name Variants

Bilge A.

BILGE, Ayşe Hümeyra

Bilge, AYŞE HÜMEYRA

Bilge, Ayse Humeyra

AYŞE HÜMEYRA BILGE

A. Bilge

Bilge,Ayse Humeyra

Ayşe Hümeyra Bilge

Bilge,A.H.

BILGE, AYŞE HÜMEYRA

Kupeli A.

B., Ayşe Hümeyra

Bilge, Ayşe Hümeyra

B.,Ayse Humeyra

Bilge, A. H.

Ayse Humeyra, Bilge

A. H. Bilge

B., Ayse Humeyra

Bilge, A.

Ayşe Hümeyra BILGE

Hümeyra Bilge, Ayşe

Bilge, Ayşe Humeyra

Bilge, Ayşe

Bilge, Ayşe Hümeyra

Bilge, Ayşe Hümeyra

Bilge, Ayşe Hümeyra

BILGE, Ayşe Hümeyra

Bilge, AYŞE HÜMEYRA

Bilge, Ayse Humeyra

AYŞE HÜMEYRA BILGE

A. Bilge

Bilge,Ayse Humeyra

Ayşe Hümeyra Bilge

Bilge,A.H.

BILGE, AYŞE HÜMEYRA

Kupeli A.

B., Ayşe Hümeyra

Bilge, Ayşe Hümeyra

B.,Ayse Humeyra

Bilge, A. H.

Ayse Humeyra, Bilge

A. H. Bilge

B., Ayse Humeyra

Bilge, A.

Ayşe Hümeyra BILGE

Hümeyra Bilge, Ayşe

Bilge, Ayşe Humeyra

Bilge, Ayşe

Bilge, Ayşe Hümeyra

Bilge, Ayşe Hümeyra

Bilge, Ayşe Hümeyra

Job Title

Prof. Dr.

Email Address

Main Affiliation

Industrial Engineering

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

15

LIFE ON LAND

0

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

0

Research Products

14

LIFE BELOW WATER

0

Research Products

6

CLEAN WATER AND SANITATION

1

Research Products

3

GOOD HEALTH AND WELL-BEING

20

Research Products

17

PARTNERSHIPS FOR THE GOALS

1

Research Products

4

QUALITY EDUCATION

0

Research Products

2

ZERO HUNGER

0

Research Products

10

REDUCED INEQUALITIES

0

Research Products

7

AFFORDABLE AND CLEAN ENERGY

2

Research Products

13

CLIMATE ACTION

0

Research Products

1

NO POVERTY

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

0

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

0

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

1

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

5

Research Products

5

GENDER EQUALITY

0

Research Products

Documents

81

Citations

552

h-index

12

Documents

67

Citations

450

Scholarly Output

65

Articles

43

Views / Downloads

466/6844

Supervised MSc Theses

12

Supervised PhD Theses

1

WoS Citation Count

286

Scopus Citation Count

362

WoS h-index

9

Scopus h-index

10

Patents

0

Projects

0

WoS Citations per Publication

4.40

Scopus Citations per Publication

5.57

Open Access Source

46

Supervised Theses

13

| Journal | Count |

|---|---|

| Journal of Physics: Conference Series | 6 |

| International Journal of Energy Economics and Policy | 5 |

| Energy Strategy Reviews | 2 |

| Modern Physics Letters B | 2 |

| Osmaniye Korkut Ata Üniversitesi Fen Bilimleri Enstitüsü Dergisi (Online) | 2 |

Current Page: 1 / 7

Scopus Quartile Distribution

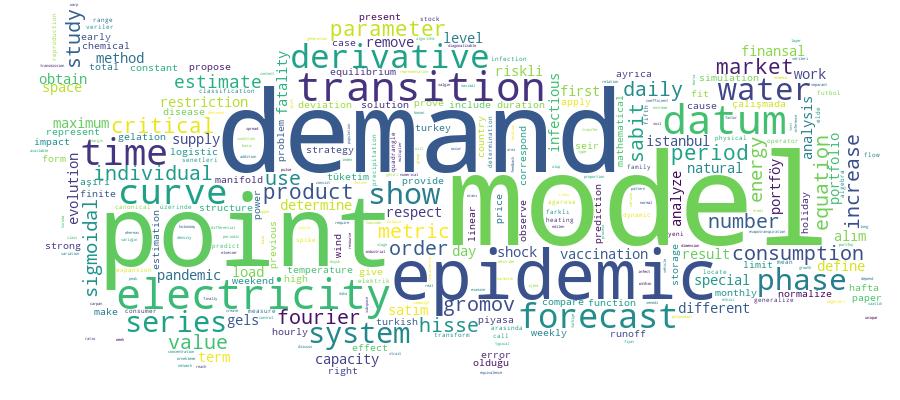

Competency Cloud

65 results

Scholarly Output Search Results

Now showing 1 - 10 of 65

Master Thesis Kurumsal Kredi Risk Değerlendirmesi: Bir Türk Finans Kurumu Örneği(2023) Hajjaouı, Btıssam; Bilge, Ayşe HümeyraBu tez iki bölümden oluşmaktadır. İlk bölümde, bir müşterinin ödeme yapıp yapmayacağını tahmin etmeye çalışıyoruz. İkinci bölümde, kredi başvurusunun onaylanıp onaylanmayacağına karar vermek için bir kredi skoru modeli oluşturma üzerine çalışıyoruz. Bu amaçla kullanılan veri kümesi, finans sektöründeki önde gelen kurumlardan birinden elde edilmiştir. Veri kümesi, başvuru sahibinin verilerine, kurumsal verilere, hissedar verilerine ve kredi geçmişine genel olarak atıfta bulunan 401 değişkeni içerir. Bu değişkenler içerisinden, giriş değişkenlerini ayırt ederek ve ardından bu girişleri inceleyerek kuvvetli ilişkili değişkenleri ve neredeyse tamamı eksik değerlerden oluşan değişkenleri kullanmaktan kaçınarak azaltıyoruz. Veri kümesindeki değişkenlerin büyük bir kısmında haklı sebeplerle eksik giriş bulunmaktadır. Bu sorunu çözmek için, hangi değişken grubunun hangi müşteriyle ilgili olduğunu yansıtmak adına yedi alt küme oluşturduk. Onaylanan krediler arasında yaklaşık %96 oranında ödeme yapan örnekler ve %4 oranında ödeme yapmayan örnekler bulunmaktadır. Bu tezde, eğitim kümelerindeki örnekleri dengelemek için üç örnekleme tekniği kullanıyoruz: alt örnekleme, aşırı örnekleme ve sentetik azınlık aşırı örnekleme tekniği. Ayrıca altı sınıflandırıcı uyguluyoruz: Rastgele Orman, Naif Bayes, Lojistik Regresyon, Destek Vektör Makinesi, Karar Ağacı ve K-En Yakın Komşu. Bu tekniklerin performansını ölçmek adına, çoğunluk sınıfının ve azınlık sınıfının sırasıyla ne kadar iyi tahmin edildiğini ölçmek için duyarlılık ve özgüllük kullanıyoruz. Hesaplamalar sonucunda, %50'den fazla duyarlılık ve özgüllük elde ettik, burada alt örnekleme tekniğinin azınlık sınıfı için en iyi örnekleme tekniği olduğu ve SMOTE ve aşırı örneklemenin, çoğunluk sınıfı için daha iyi performans gösterdiği gözlemlenmiştir. Seçilen değişkenlerin analizinde, neredeyse tüm değişkenlerin onaylanan ve reddedilen krediler arasında ayrım yapamadığı gözlemlendiği için lojistik regresyon kullanılarak tahmin edilen kredi puanları güvenilmez olarak değerlendirildi.Article Citation - WoS: 7Citation - Scopus: 12An Analysis of Price Spikes and Deviations in the Deregulated Turkish Power Market(Elsevier, 2019) Gayretli, Gizem; Yücekaya, Ahmet; Bilge, Ayşe HümeyraThe successful operation of a real time market is related to the planning in the day ahead market. We analyze the day ahead and real time market data for the Turkish power market for the period 2012-2015 to classify price spikes and their causes. We also focus on the levels of deviation between the day ahead market values and the real time market values. We define price deviation and load deviation ratios to measure the level of deviation both in price and demand. The analysis for the load is based on load shedding and cycling values. We analyze the mean and standard deviation in market prices and we determine the price spike as a two sigma deviation from the mean value. It is shown that 60% of the price deviation ratios are in the range of ( +/- 20%), while 44% are in the range of ( +/- 10%) and 35% are in the range of (+/- 5%). We also show that 56.9% of the spikes are due to problems in the generation of natural gas based power plants which affect the day ahead and real time prices. A total of 29.2% of the spikes are due to power plant and system failures that affect only real time prices. The share of high temperature based spikes is 13.9% which is a result of air conditioner usage.Article Citation - WoS: 2Citation - Scopus: 2Mathematical Models for Phase Transitions in Biogels(World Scientific Publ Co Pte Ltd, 2019) Bilge, Ayşe Hümeyra; Öğrenci, Arif Selçuk; Pekcan, ÖnderIt has been shown that reversible and irreversible phase transitions of biogels can be represented by epidemic models. The irreversible chemical sol-gel transitions are modeled by the Susceptible-Exposed-Infected-Removed (SEIR) or Susceptible-Infected-Removed (SIR) epidemic systems whereas reversible physical gels are modeled by a modification of the Susceptible-Infected-Susceptible (SIS) system. Measured sol-gel and gel-sol transition data have been fitted to the solutions of the epidemic models, either by solving the differential equations directly (SIR and SEIR models) or by nonlinear regression (SIS model). The gel point is represented as the "critical point of sigmoid," defined as the limit point of the locations of the extreme values of its derivatives. Then, the parameters of the sigmoidal curve representing the gelation process are used to predict the gel point and its relative position with respect to the transition point, that is, the maximum of the first derivative with respect to time. For chemical gels, the gel point is always located before the maximum of the first derivative and moves backward in time as the strength of the activation increases. For physical gels, the critical point for the sol-gel transition occurs before the maximum of the first derivative with respect to time, that is, it is located at the right of this maximum with respect to temperature. For gel-sol transitions, the critical point is close to the transition point; the critical point occurs after the maximum of the first derivative for low concentrations whereas the critical point occurs after the maximum of the first derivative for higher concentrations.Doctoral Thesis Models for Electricity Demand Forecasting, Classification, and Imbalance Reduction in Competitive Markets(Kadir Has Üniversitesi, 2023) Yükseltan, Ergün; Yücekaya, Ahmet Deniz; Bilge, AyşeIn liberalized energy markets, hourly forecasts of consumers and producers are crucial for efficiently using energy resources and reducing environmental impacts. In this study, the countries’ consumption in the ENTSO-E common network between 2006 and 2018 was analyzed using the time series method. With the created model, short, medium, and long-term demand forecasts are made using Fourier Series Expansion. In order to improve the error rate of short-term forecasts, a hybrid model was created with alternatively created feedback and autoregressive methods. While annual forecasts are made with an average error rate of 6%, the error rate in daily forecasts is around 4.5%. With the hybrid models created, hourly estimates can be made with approximately 1.5% and 1% error rates. Accurate estimations are of great importance in terms of the efficiency of energy markets, and the emergence of energy storage opportunities with the developing technology increases this importance. For this reason, the amount of imbalance was estimated by using the forecast result of the hybrid model in the Turkish Energy Market, and a strategy was developed to reduce the imbalance cost accordingly. With this strategy, simulations have been made for situations with and without storage, and the results have been shared.Editorial Editorial: Compartmental Models for Social Interactions(Frontiers Media Sa, 2024) Bilge, Ayse Humeyra; Peker-Dobie, Ayse; Severin, Irina; Piqueira, Jose Roberto Castilho; Bellingeri, Michele; Prodanov, Dimiter[No Abstract Available]Master Thesis Bankacılık Hisse Senetleri Üzerine Endekse Dayalı Bir Alım Satım Stratejisi Önerisi(Kadir Has Üniversitesi, 2017) Yeniay, Ozan; Bilge, Ayşe HümeyraBatıda uzun zamandır uygulanan, Türkiye'de yeni yeni uygulanmaya başlayan ve her geçen yıl önemini artıran algoritmik alım satım yöntemi yatırımcılara büyük avantajlar sağlamaktadır. Algoritmik alım satım yöntemleri sayesinde küçük yatırımcılar dahi koruma amaçlı fon ( Hedge Fon ) yatırım bankaları ve profesyonel yatırımcılar tarafından uygulanan alım satım tekniklerini uygulayabilmekte ve geriye dönük testlerini yapabilmektedir. Bu tezin amacı algoritmik alım satım teknikleri yardımıyla, eş işlem stratejisine (Pairs Trading) alternatif bir model geliştirilerek, bu modele istinaden yapılabilecek alım satım işlemlerinin performansın incelemektir. Oluşturulan model Borsa İstanbul bünyesinde hesaplanan bankacılık endeksinde yer alan, bankacılık hisselerinde test edilmiştir. Araştırmada, endeksin kendi saatlik volatilitesinin üzerinde bir hareket yapması beklenmiş ve bu hareketin ardından hisse senetlerinin de hareketi takip etmesi gerektiği varsayımı üzerinden iki ana alım stratejisi oluşturularak bu stratejilerin geriye dönük test ve optimizasyonları yapılmıştır. Seçilen hisse senetlerinin endeks ile korelasyonunun yüksek olması dikkate alınmıştır. Hisse senetleri ve endekslerin korelasyonları ve volatiliteleri Matlab programı vasıtasıyla hesaplanmış ve geriye dönük testler Matriks programının "system tester" modülü kullanılarak gerçekleştirilmiştir. Araştırma Türkiye'de siyasi ve ekonomik risklerin arttığı 2013 yılı sonrasını kapsamaktadır ve bu süreçte dahi, geliştirilen stratejiler sayesinde al tut stratejisi ve piyasa faiz oranının üzerinde getiriler elde edilmiştir.Article Citation - WoS: 44Citation - Scopus: 52Hourly Electricity Demand Forecasting Using Fourier Analysis With Feedback(Elsevıer, 2020) Yükseltan, Ergün; Yücekaya, Ahmet; Bilge, Ayşe HumeyraWhether it be long-term, like year-ahead, or short-term, such as hour-ahead or day-ahead, forecasting of electricity demand is crucial for the success of deregulated electricity markets. The stochastic nature of the demand for electricity, along with parameters such as temperature, humidity, and work habits, eventually causes deviations from expected demand. In this paper, we propose a feedback-based forecasting methodology in which the hourly prediction by a Fourier series expansion is updated by using the error at the current hour for the forecast at the next hour. The proposed methodology is applied to the Turkish power market for the period 2012-2017 and provides a powerful tool to forecasts the demand in hourly, daily and yearly horizons using only the past demand data. The hourly forecasting errors in the demand, in the Mean Absolute Percentage Error (MAPE) norm, are 0.87% in hour-ahead, 2.90% in day-ahead, and 3.54% in year-ahead horizons, respectively. An autoregressive (AR) model is also applied to the predictions by the Fourier series expansion to obtain slightly better results. As predictions are updated on an hourly basis using the already realized data for the current hour, the model can be considered as reliable and practical in circumstances needed to make bidding and dispatching decisions.Article Citation - WoS: 4Citation - Scopus: 11A Susceptible-Infectious (si) Model With Two Infective Stages and an Endemic Equilibrium(Elsevier, 2022) Ahmetolan, Semra; Demirci, Ali; Bilge, Ayse Humeyra; Dobie, Ayse PekerThe focus of this article is on the dynamics of a susceptible-infected model which consists of a susceptible group (S) and two different infectious groups (I-1 and I-2). Once infected, an individual becomes a member of one of these infectious groups which have different clinical forms of infection. In addition, during the progress of the illness, an infected individual in group I-1 may pass to the infectious group I-2 which has a higher mortality rate. The infection is deadly and it has no cure. In this study, positiveness of the solutions for the model is proved. Stability analysis of species extinction, I-1-free equilibrium and endemic equilibrium as well as disease-free equilibrium is studied, and it is shown that the disease-free equilibrium is stable whereas all other equilibrium points are asymptotically stable for parameter ranges determined by certain inequalities. In addition, relations between the basic reproduction number of the disease and the basic reproduction number of each infectious stage are examined. Furthermore, the case where all newborns from infected mothers are also infected is analysed. For this type of vertical transmission, endemic equilibrium is asymptotically stable for certain parameter ranges. Finally, a special case which refers to the disease without vital dynamics is investigated and its exact solution is obtained. (c) 2021 International Association for Mathematics and Computers in Simulation (IMACS). Published by Elsevier B.V. All rights reserved.Article Citation - WoS: 14Citation - Scopus: 13Mathematical Characterization of Thermo-Reversible Phase Transitions of Agarose Gels(Taylor & Francis Inc, 2018) Öğrenci, Arif Selçuk; Pekcan, Önder; Kara, Selim; Bilge, Ayşe HümeyraThe thermal phase transition temperatures of high (HMP) and low melting point (LMP) agarose gels were investigated by using UV-vis spectroscopy techniques. Transmitted light intensities from the gel samples with different agarose concentrations were monitored during the heating (gel-sol) and cooling (sol-gel) processes. It was observed that the transition temperatures T-m defined as the location of the maximum of the first derivative of the sigmoidal transition paths obtained from the UV-vis technique slightly increased by increasing the agarose concentration in both the HMP and LMP samples. Here we express the phase transitions of the agar-water system as a representative of reversible physical gels in terms of a modified Susceptible-Infected-Susceptible epidemic model whose solutions are the well-known 5-point sigmoidal curves. The gel point is hard to determine experimentally and various computational techniques are used for its characterization. Based on previous work we locate the gel point T-0 of sol-gel and gel-sol transitions in terms of the horizontal shift in the sigmoidal transition curve. For the gel-sol transition (heating) T-0 is greater than T-m i.e. later in time and the difference between T-0 and T-m is reduced as the agarose content increases. For the sol-gel transition (cooling) T-0 is again greater than T-m but it is earlier in time for all agarose contents and moves forward in time and gets closer to T-m as the agarose content increases.Article Citation - WoS: 2Citation - Scopus: 2On the Classification of Fifth Order Quasi-Linear Non-Constant Separant Scalar Evolution Equations of the Kdv-Type(Physical Soc Japan, 2012) Özkum, Gülcan; Bilge, Ayşe HümeyraFifth order, quasi-linear, non-constant separant evolution equations are of the form u(t) = A(partial derivative(5)u/partial derivative x(5)) + (B) over tilde, where A and (B) over tilde are functions of x, t, u and of the derivatives of u with respect to x up to order 4. We use the existence of a "formal symmetry'', hence the existence of "canonical conservation laws'' rho((i)), i = -1, . . . , 5 as an integrability test. We define an evolution equation to be of the KdV-Type, if all odd numbered canonical conserved densities are nontrivial. We prove that fifth order, quasi-linear, non-constant separant evolution equations of KdV type are polynomial in the function a = A(1/5); a = (alpha u(3)(2) + beta u(3) + gamma)(-1/2), where alpha, beta, and gamma are functions of x, t, u and of the derivatives of u with respect to x up to order 2. We determine the u(2) dependency of a in terms of P = 4 alpha gamma - beta(2) > 0 and we give an explicit solution, showing that there are integrable fifth order non-polynomial evolution equations.