Öztürk Danışman, Gamze

Loading...

Profile URL

Name Variants

Öztürk Danışman, Gamze

G.,Öztürk Danışman

G. Öztürk Danışman

Gamze, Öztürk Danışman

Ozturk Danisman, Gamze

G.,Ozturk Danisman

G. Ozturk Danisman

Gamze, Ozturk Danisman

Danışman, Gamze Öztürk

Ozturk-Danisman, Gamze

Danisman, Gamze Ozturk

G.,Öztürk Danışman

G. Öztürk Danışman

Gamze, Öztürk Danışman

Ozturk Danisman, Gamze

G.,Ozturk Danisman

G. Ozturk Danisman

Gamze, Ozturk Danisman

Danışman, Gamze Öztürk

Ozturk-Danisman, Gamze

Danisman, Gamze Ozturk

Job Title

Dr. Öğr. Üyesi

Email Address

Gamze.danı[email protected]

Main Affiliation

International Trade and Finance

Status

Former Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

15

LIFE ON LAND

0

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

0

Research Products

14

LIFE BELOW WATER

0

Research Products

6

CLEAN WATER AND SANITATION

0

Research Products

3

GOOD HEALTH AND WELL-BEING

1

Research Products

17

PARTNERSHIPS FOR THE GOALS

0

Research Products

4

QUALITY EDUCATION

0

Research Products

2

ZERO HUNGER

0

Research Products

10

REDUCED INEQUALITIES

6

Research Products

7

AFFORDABLE AND CLEAN ENERGY

0

Research Products

13

CLIMATE ACTION

1

Research Products

1

NO POVERTY

0

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

1

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

3

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

0

Research Products

5

GENDER EQUALITY

0

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

18

Articles

16

Views / Downloads

207/2290

Supervised MSc Theses

2

Supervised PhD Theses

0

WoS Citation Count

785

Scopus Citation Count

882

WoS h-index

10

Scopus h-index

11

Patents

0

Projects

0

WoS Citations per Publication

43.61

Scopus Citations per Publication

49.00

Open Access Source

10

Supervised Theses

2

| Journal | Count |

|---|---|

| SSRN Electronic Journal | 3 |

| Journal of Financial Stability | 2 |

| Ege Akademik Bakis (Ege Academic Review) | 1 |

| Ege Akademik Bakış | 1 |

| Finance Research Letters | 1 |

Current Page: 1 / 3

Scopus Quartile Distribution

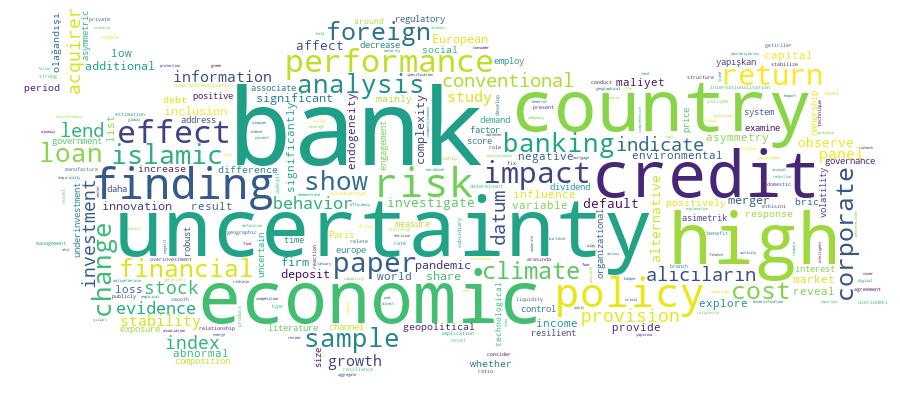

Competency Cloud

18 results

Scholarly Output Search Results

Now showing 1 - 10 of 18

Article Citation - WoS: 71Citation - Scopus: 88Banking Sector Reactions To Covid-19: the Role of Bank-Specific Factors and Government Policy Responses(Elsevier, 2021) Demir, Ender; Danisman, Gamze OzturkThis paper examines the impact of bank-specific factors and variations in the context of stringency of government policy responses on bank stock returns because of the COVID-19 pandemic. A sample of 1,927 publicly listed banks from 110 countries is used for the period of the first major wave of COVID-19, that is, January to May 2020. Our findings indicate that stock returns of banks with higher capitalization and deposits, more diversification, lower non-performing loans, and larger size are more resilient to the pandemic. While banks' environment and governance scores do not have a significant impact, higher social and corporate social responsibility strategy scores intensify the negative stock price reaction to COVID-19. We further observe that the pandemic induced reduction in bank stock prices is mitigated as the strictness of government policy responses increases, mainly through economic responses such as income support, debt and contract relief, and fiscal measures from governments.Article Citation - WoS: 86Citation - Scopus: 91The Impact of Economic Uncertainty and Geopolitical Risks on Bank Credit(Elsevier Inc., 2021) Demir, Ender; Danışman, Gamze ÖztürkThis paper compares the effects of economic uncertainty and geopolitical risks on bank credit growth. Using a sample of 2439 banks from 19 countries for the period of 2010–2019, our findings indicate that economic uncertainty causes a significant decrease in overall bank credit growth while no such significant overall effect of geopolitical risks is documented. Further analysis on loan types shows that the highest negative impact of economic uncertainty is observed on corporate loans. Geopolitical risk, however, dampens consumer and mortgage loans. Additional analyses on bank heterogeneity reveal that the credit behavior of foreign and publicly listed banks are more immune to such risks.Article Asimetrik Maliyet Davranışı ve Alıcıların Getirileri: A.b.d. Birleşmelerinden Bulgular(2019) Ugurlu, Mine; Danışman, Gamze Öztürk; Bılyay-erdogan, Seda; Vural-yavas, CigdemBu çalışma alıcıların satış, genel ve yönetim maliyetlerinin asimetrik davranışlarını incelemekle birlikte; “Birleşme ve Satın Alma” performanslarına olan etkisini 1 yıllık olay penceresinden analiz etmektedir. Çalışma A.B.D.’de 2003-2015 yılları arasında tamamlanan 6,888 birleşme ve satınalmaya dayanmakta ve panel veri regresyonları kullanmaktadır. Sonuçlar alıcıların 73%’ünün maliyetlerinin asimetrik davranış sergilediğini göstermektedir. Birleşme duyurusunun ardından maliyet yapışkanlığı ile alıcıların olağandışı getirileri arasında anlamlı ve negatif bir ilişki olduğu saptanmıştır. Piyasadaki rekabet alıcıların getirilerini olumlu etkiler, ancak yapışkan maliyetlerin alıcıların olağandışı getirileri üzerindeki olumsuz etkisini daha da artırır. Ayrıca alıcıların temerrüt riskinin olağandışı getiriler üzerinde anlamlı ve negatif yönde etkisi vardır. Bununla birlikte, temerrüt riskinin getiriler üzerindeki olumsuz etkisi yapışkan olmayan maliyet yapısı olan alıcılar için daha kuvvetlidir. Alıcıların riski rekabetin getiriler üzerindeki pozitif etkisini azaltmaktadır. Bir yıllık olay penceresinden incelendiğinde, yapışkan maliyet yapısına sahip alıcıların yapışkan olmayan maliyet yapısına sahip alıcılara göre daha az olağandışı getirilere sahip olduğu gözlemlenmiştir. Bu çalışma 2003-2015 yılları arasında gerçekleşen birleşmelerde rol alan alıcıların asimetrik maliyet davranışlarını ortaya çıkararak ve alıcı firmaların daha düşük olağandışı getiri elde etmelerine alternatif bir açıklama getirerek literatüre katkıda bulunmuştur.Article Citation - WoS: 128Citation - Scopus: 131ESG performance and investment efficiency: The impact of information asymmetry(Elsevier, 2024) Bilyay-Erdogan, Seda; Danisman, Gamze Ozturk; Demir, EnderThis paper investigates the relationship between firms' engagement in environmental, social, and governance (ESG) activities and corporate investment efficiency, using 1,094 firms from 21 countries in Europe, covering the years 2002-2019. We conduct our estimations using fixed effects panel data techniques and address potential endogeneity with instrumental variables (IV) estimations. We provide evidence that overall ESG engagement is positively and significantly associated with investment efficiency. Analyzing overinvestment and underinvestment scenarios shows that ESG engagement decreases only overinvestment problems. Within the underinvestment scenario, we observe that ESG engagement is beneficial only for firms with higher information asymmetries. Thus, information asymmetry matters in the underinvestment case. We next show that four firm-level channels-information asymmetry, financial constraints, cash flows, and risk-link ESG performance to investment inefficiency. Additional analysis shows that firms with extreme ESG scores (i.e., very low and very high) do not experience significant reductions in investment inefficiency. Altogether, our findings draw attention to the critical role of ESG performance and information asymmetry in determining corporate investment efficiency.Article Citation - WoS: 1Citation - Scopus: 3The Effect of Pandemics on Domestic Credit: a Cross-Country Analysis(Economics Bulletin, 2021) Danisman, Gamze Ozturk; Demir, EnderUsing a panel of 140 countries covering the period 1996-2018, this paper examines how previous pandemics (such as SARS, MERS, Ebola, Swine flu, etc.) have influenced the lending behavior of banks. We take advantage of a new index developed by Ahir et al. (2020) which measures discussions about pandemics at the country level. Our findings reveal that uncertainty related to pandemics significantly hamper domestic credit available to the private sector. The negative effect of pandemics on credit levels is more prevalent for the low-income & emerging economies and non-OECD countries.Article Citation - WoS: 2Asymmetric Cost Behavior and Acquirer Returns: Evidence From U.s. Mergers(Ege Univ, 2019) Uğurlu, Mine; Öztürk Danışman, Gamze; Bilyay-Erdoğan, Seda; Vural-Yavaş, ÇiğdemThis paper investigates the asymmetric behavior of the selling, general and administrative (SG&A) costs of acquirers, and reveals its effects on mergers & acquisitions (M&A) performance in a one-year event window. It is based on a sample of 6888 M&As completed in the U.S. during the 2003-2015 period and employs panel data regressions. The results show that 73% of the acquirers display asymmetric cost behavior. A significant negative relation is found between cost stickiness and acquirers' abnormal returns following the merger announcement. Competition in the market for corporate control is positively related with acquirer returns but exacerbates the negative effects of cost-stickiness on abnormal returns of acquirers. The acquirers' risk of default is significantly negatively related to the abnormal returns they generate. This adverse effect of default risk on returns is stronger for acquirers with anti-sticky costs. Acquirer risk offsets the positive effects of competition on returns. Acquirers with sticky costs have lower abnormal returns than those with anti-sticky costs in a one-year window. The present study contributes to the literature by revealing the asymmetric cost behavior of acquirers involved in merger activity during the last decade, and provides evidence for an alternative explanation for the lower abnormal returns of the acquiring firms.Article Citation - WoS: 80Citation - Scopus: 86Economic Policy Uncertainty and Bank Credit Growth: Evidence From European Banks(Elsevier B.V., 2020) Danışman, Gamze Öztürk; Ersan, Oğuz; Demir, EnderUsing a sample of 2977 private and listed banks in the EU-5 countries (the United Kingdom, Germany, Spain, Italy, France) for the years 2009–2018, this paper explores the impact of Economic Policy Uncertainty (EPU) on credit growth. Using panel data fixed effects methodology and controlling for endogeneity using two-step difference GMM estimators, our findings indicate that uncertainty in economic policies hampers the credit growth of European banks. Our bank type-based analyses indicate that the effect is mainly valid for cooperative banks. Additional analyses imply that the negative impact of EPU on credit growth is more pronounced in civil law countries, increases with debt maturity, and weakens for banks with a larger number of employees and branches. Furthermore, the unfavorable effects are stronger in well-capitalized banks, banks with foreign subsidiaries, and banks with a higher share of wholesale funding. We also provide several policy implications for different economic actors.Article Citation - WoS: 2Citation - Scopus: 4Economic Uncertainty and Climate Change Exposure(Academic Press Ltd- Elsevier Science Ltd, 2025) Danisman, Gamze Ozturk; Bilyay-Erdogan, Seda; Demir, EnderThis paper explores how economic uncertainty affects firms' climate change exposure. We use an extensive sample from 24 countries from 2002 to 2021. Employing a novel measure of firm-level climate change exposure developed by Sautner et al. (2023b), we empirically demonstrate that prior to the Paris Agreement in 2015, economic uncertainty leads to a decrease in climate change disclosures. However, after the Paris Agreement, our findings reveal a positive association between economic uncertainty and climate change exposure. The positive disclosure effect is primarily driven by higher climate-related opportunities and regulatory exposures. Our findings are robust when we employ alternative definitions for economic uncertainty, alternative samples, additional firm-level and country-level control variables, and alternative methodologies. We find that institutional and foreign ownership positively moderates the association between economic uncertainty and climate change exposure after the Paris Agreement. Further analysis investigates the moderating impact of country-level environmental performance indicators. We present novel empirical evidence suggesting that firms operating in countries with less climate vulnerability, higher readiness, more stringent environmental policies, superior climate protection performance, and higher environmental litigation risk tend to have higher climate change exposure in uncertain times.Article Citation - WoS: 89Citation - Scopus: 115Financial Inclusion and Bank Stability: Evidence From Europe(Routledge Journals, 2020) Danışman, Gamze Öztürk; Tarazi, AmineThe Great Recession of 2007-2009 piqued the interest of policymakers worldwide, prompting various initiatives to stabilize the financial system and advance financial inclusion. However, few studies have considered their interconnectedness or whether any synergies or trade-offs exist between them. This paper investigates how financial inclusion affects the stability of the European banking system. The findings indicate that advancements in financial inclusion through more account ownership and digital payments have a stabilizing effect on the banking industry. A deeper investigation shows that such a stabilizing impact is mainly driven by the targeting of disadvantaged adults who are young, undereducated, unemployed, and who live in rural areas. Hence, along with its known benefits to society as a whole, financial inclusion has the additional benefit of improving the stability of the financial system. Such findings call for policy configurations that are specifically designed to achieve financial inclusion for disadvantaged individuals.Master Thesis Determinants of Bank Lending 'evidence From Brics Countries'(Kadir Has Üniversitesi, 2023) Ahmed, Abdullai; Öztürk Danışman, GamzeThis thesis aims to investigate the determinants of bank lending for the countries forming BRICS, namely Brazil, Russia, India, China, and South Africa. The empirical analysis is performed using a sample of 130 listed commercial banks between 2000 and 2021. While bank-level data is obtained from Thomson Reuters Refinitiv Eikon, country-level data is extracted from the World Bank. The study uses panel data estimation techniques with fixed effects regression models. Study findings show that bank size, capital adequacy ratio, credit risk, the share of deposits and return on asset have a direct influence on bank lending in BRICS countries since all these variables are statistically significant. Larger banks are observed to lend more, and banks with higher shares of deposit, higher capital adequacy ratios, higher return on assets and higher credit risk are observed to lend more. Country-level variables such as gross domestic product per capita, real interest rate, deposit interest rate, and lending interest rate have no direct impact on bank lending. In contrast, banks in countries with higher inflation lend more. This study points out differences in the determinants of bank lending in the BRICS countries versus the rest of the world and offers important policy implications.