Davutyan, Nurhan

Loading...

Profile URL

Name Variants

Davutyan, Nurhan

N.,Davutyan

N. Davutyan

Nurhan, Davutyan

Davutyan, Nurhan

N.,Davutyan

N. Davutyan

Nurhan, Davutyan

N.,Davutyan

N. Davutyan

Nurhan, Davutyan

Davutyan, Nurhan

N.,Davutyan

N. Davutyan

Nurhan, Davutyan

Job Title

Email Address

Main Affiliation

International Trade and Finance

Status

Former Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

15

LIFE ON LAND

0

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

0

Research Products

14

LIFE BELOW WATER

0

Research Products

6

CLEAN WATER AND SANITATION

0

Research Products

3

GOOD HEALTH AND WELL-BEING

0

Research Products

17

PARTNERSHIPS FOR THE GOALS

2

Research Products

4

QUALITY EDUCATION

0

Research Products

2

ZERO HUNGER

0

Research Products

10

REDUCED INEQUALITIES

1

Research Products

7

AFFORDABLE AND CLEAN ENERGY

0

Research Products

13

CLIMATE ACTION

0

Research Products

1

NO POVERTY

1

Research Products

9

INDUSTRY, INNOVATION AND INFRASTRUCTURE

0

Research Products

12

RESPONSIBLE CONSUMPTION AND PRODUCTION

0

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

2

Research Products

11

SUSTAINABLE CITIES AND COMMUNITIES

0

Research Products

5

GENDER EQUALITY

0

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

12

Articles

4

Views / Downloads

83/1529

Supervised MSc Theses

5

Supervised PhD Theses

1

WoS Citation Count

33

Scopus Citation Count

42

WoS h-index

3

Scopus h-index

3

Patents

0

Projects

0

WoS Citations per Publication

2.75

Scopus Citations per Publication

3.50

Open Access Source

6

Supervised Theses

6

| Journal | Count |

|---|---|

| Emerging Markets Finance and Trade | 1 |

| Journal of Balkan and Near Eastern Studies | 1 |

| Middle East Development Journal | 1 |

| The European Journal of Finance | 1 |

Current Page: 1 / 1

Scopus Quartile Distribution

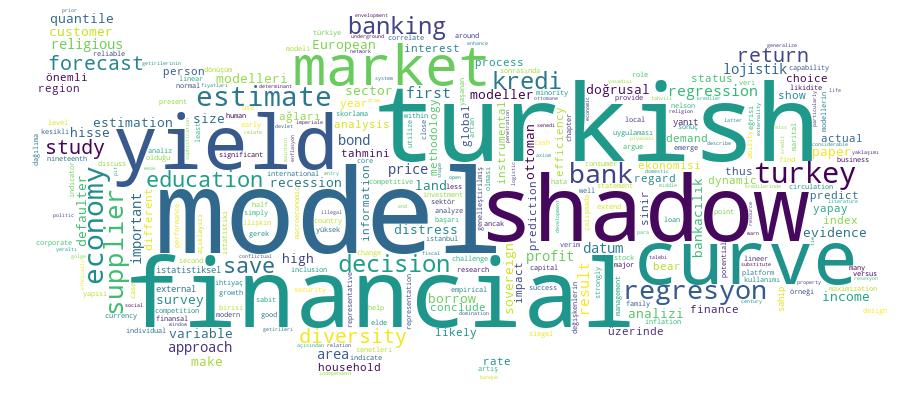

Competency Cloud

12 results

Scholarly Output Search Results

Now showing 1 - 10 of 12

Book Part Choice of Finance in an Emerging Market: the Impact of Independent Decisions Politics and Religion(Springer International Publishing, 2017) Davutyan, Nurhan; Öztürkkal, BelmaThis paper is based on a KONDA 1 Research and Consultancy 2 survey conducted in May 2014 on 2607 people forming a representative sample of the Turkish population. It focuses on how people’s religious and political characteristics impact the independence of their decision making regarding saving and borrowing. An earlier study by Davutyan and Ozturkkal (2016) reports saving and borrowing decisions strongly correlate with income, education, marital status and region within country. Furthermore, 54% of those surveyed did not save and the main motivation for those who saved was to finance children’s education or home purchase. Religious people and those with a conservative lifestyle are less likely to borrow from family and friends. Older, married and working individuals are more likely to have difficulty paying back loans. According to the results of this survey, religious individuals are less likely to independently decide on their investment choices. Thus, religious people tend to make investment decisions together with family, elderly and respected relatives.Doctoral Thesis İhtiyaç Kredilerinde Yapay Sinir Ağları Uygulaması(Kadir Has Üniversitesi, 2018) Sayıcı, Selim Caner; Davutyan, NurhanTürkiye ekonomisinde finansal sektör ve bankacılık sektörü önemli bir role sahiptir. Özelikle 2001 krizi sonrasında Türk bankacılık sektörünün aktifinde yaşanan artış ile bankacılık sektörünü bölgedeki en güçlü bankacılık sektörlerinden birisi olmuştur. 2001-2015 arasına sektör ciddi oranda yüksek bir artış yakalamıştır. Sektörün aktif büyüklüğe ulaşmasında kredilerde yaşanan artışların önemli katkısı olmuştur. Artan kredi plasmanı bankalardaki riskinde artmasına neden olmuştur. Bankalar artan kredi risklerini düşürmek amacıyla farklı kredi skorlama modelleri denemektedir. Söz konusu kredi skorlama modelleri bankaların kredi süreçlerinde önemli bir yere sahiptir. Günümüzde geleneksel modellerin yanı sıra modern istatistiki tekniklere de yer verilmektedir. Çalışmada modern istatistiki yöntemlerden birisi olan yapay sinir ağları uygulamasına yer verilmiştir. Çalışmada bir bankanın ihtiyaç kredisi kullanan müşterilerine ilişkin veriler ile makro verilere yer verilerek analizler yapılmıştır. Analizlerde yapay sinir ağları içerisindeki veri setinin kısımları ile gizli katmanda yer alan nöron sayıları değiştirilerek başarı oranı yüksek modeller elde edilmeye çalışılmıştır. Sonrasında gri bölge tanımlaması ve ihtiyaç kredileri özelinde finansal analiz yapılmıştır. Sonuç kısmında ise tüm modeller birbirleriyle karşılaştırılarak en başarı model bulunmaya çalışılmıştır.Master Thesis Hisse Senetleri Getirilerinin Lojistik Regresyon ve Doğrusal Regresyon Modelleri ile Bir Analizi(Kadir Has Üniversitesi, 2014) Sarı, Burcu; Davutyan, Nurhan; Altaylıgil, Yasin BarışBu tezde İstanbul BIST100 A kategorisi hisse senetlerinin net ve brüt getiri değerleri üzerinde doğrusal regresyon ve lojistik regresyon modelleri uygulaması yapılmıştır. Regresyon modellerinde model parametrelerinin tahmini, model parametreleri üzerindeki istatistiksel testler ve güven aralıkları, kısaca istatistiksel sonuç çıkarımı, için hata terimleri ve dolayısıyla yanıt ve açıklayıcı değişkenlerin normal dağılıma sahip olduğu varsayımı önemlidir. Ancak bu varsayımın tam olarak sağlanamadığı ve model kestirimlerinin sabit olmayan varyansa sahip olması gibi pek çok modelleme sorunu ortaya çıkmaktadır. Böyle bir durumda, varyansı sabitleştirmek için model değişkenleri üzerinde dönüşüm işlemleri yapılması yoluna gidilebilmektedir. Ancak, normallik, sabit varyans ve basit model formu gibi bir istatistiksel modellemede istenilen özelliklerin tümünün sadece dönüşüm ile elde edilemediği de görülmektedir. Bu bağlamda; yanıt değişkeni ve hata terimlerinin normal dağılıma sahip olması gereğini şart koşmayan Genelleştirilmiş Lineer Modeller (GLM) araçlarının kullanımı öne çıkmaktadır. Yanıt değişkenlerinin iki ve çok değerli kesikli rasgele değişkenler olduğu, açıklayıcı değişkenlerin sürekli veya kesikli değerler alabilen değişkenlerden oluşturulabildiği bir GLM türü olan lojistik regresyon modeli bunlardan biridir. Tez çalışması aynı veri kümesi üzerinde gerek doğrusal gerek lojistik regresyon modeli kullanarak hisse senetleri getirilerine ilişkin iki bakışlı bir ilişki yapısı analizi ortaya koymakta hem de bu modellerin paralel biçimde birlikte kullanımı ile analizde bir tamamlayıcılık örneği sergilemektedir.Master Thesis Estimate the Yield Curve for Sovereign Bonds in Turkey and Forecasting Turkish Economy From the Shape of Yield Curve (2005 - 2018)(Kadir Has Üniversitesi, 2019) Temuçin, Teoman Samet; Davutyan, NurhanYield curve that reflects the interest expectations of market participants is one of the cornerstones of the financial analysis. In the first chapter of our study, Turkey yield curve for sovereign bond market is estimated in 2005-2018 by using Extended NelsonSiegel (ENS) and Dynamic Nelson-Siegel (DNS) models. Since Turkish sovereign market becomes more liquid and 10-year fixed rate coupon bonds were started to be traded after 2010, this allows us to make estimation for 10-year term to maturity. As a result of estimation via two methodologies, it is concluded that Dynamic Nelson-Siegel model estimates Turkey yield curve slightly better than the Extended Nelson-Siegel model. Besides, OLS (Ordinary Least Square) is better methodology than optimization tools in DNS. This is why, the estimated Turkey yield curve via Dynamic Nelson-Siegel model with OLS methodology is used to forecast Turkish macroeconomic and financial indicators in the second chapter of the study. The yield curve can be simply perceived as a representation of interest rates of treasury bonds or other security instruments in different maturities. However, that simple graph is beyond the representation of interest rate. If it is read carefully, the market efficiency theory can be beaten and regular profits from the market can be made. Many scholars and empirical studies of them have proved the significant forecasting ability of the yield curve about recessions, turning points in the stock market and inflation rates. Therefore, it seems as a reliable mechanism for forecasting to some important indicators in the macroeconomic set. I also simply test the forecasting capabilities of the estimated Turkey yield curve on Turkish recessions, bear market, industrial production index, bist100 index and consumer price index. As a result of analysis, it is concluded that parameters, which represent the Turkey’s yield curve, contain important information and predictions regarding recessions, bear market formation, bist100 index and consumer price index.Book Part A "flying high, landing soft" platform for supplier diversity(IGI Global, 2016) Chen, Yesho; Davutyan, Nurhan; Ersoy, IrisDiversity management has emerged as a unique agenda of today's corporations in the global economy. One important area of corporate diversity management is supplier diversity, which is an inclusive growth program designed to help develop under-represented businesses into competitive suppliers of corporations. A major challenge of supplier diversity is that many minority suppliers lack the capability to deliver products which the corporate buyers need. Another major challenge is that few minority suppliers have the ability to participate in the global markets opportunities. We address these two problems by proposing an innovative "Flying High, Landing Soft" platform for international education in supplier diversity to help multinationals manage their global supplier diversity.Article Citation - WoS: 4Citation - Scopus: 7Quantile Estimates for Social Returns to Education in Turkey: 2006–2009(Routledge, 2013) Bakis, Ozan; Davutyan, Nurhan; Levent, Haluk; Polat, SezginAugmenting a Mincerian earnings function with regional data we estimate both private and external returns to education in Turkey using Instrumental Variables, Ordinary Least Squares, Quantile Regression and Instrumental Variables Quantile Regression methods. Our results indicate a median external return between 1.5% and 2.3% for 2006–2009. There is some evidence supporting the skill-biased technical change hypothesis. External returns are uniformly higher for women. We point out some policy implications.Article Citation - WoS: 18Citation - Scopus: 24Determinants of Saving-Borrowing Decisions and Financial Inclusion in a High Middle Income Country: the Turkish Case(Routledge Journals Taylor & Francis Ltd, 2016) Davutyan, Nurhan; Öztürkkal, BelmaWe use a representative survey of the Turkish household sector and investigate factors impinging on saving-borrowing behavior. We run four probit regressions to elucidate (i) the saving decision (ii) asset choice or portfolio composition for those who save (iii) the bank loan decision and lastly (iv) the formal versus informal borrowing decision. We find income education marital status and region within country strongly correlate with those decisions. We offer some insights regarding the influence of variables like rural to urban migrant status and religious belief on saving and borrowing decisions. We discuss the long-term implications of our findings on the Turkish household savings performance.Article Citation - WoS: 10Citation - Scopus: 9Efficiency in Turkish Banking: Post-Restructuring Evidence(Routledge Journals Taylor & Francis Ltd, 2017) Davutyan, Nurhan; Yıldırım, CananTurkish banking sector went through a significant restructuring process in the aftermath of the country's financial crisis of 2000-2001. In this paper we analyze the evolution of banking performance using a novel approach due to Ray [(2007). Shadow Profit Maximization and a Measure of Overall Inefficiency. Journal of Productivity Analysis 27 231-236]. We derive shadow unrealized profit scores' as well as shadow input-output prices' for each year and bank in the sector from 2002 to 2011. We argue these scores operationalize the Hicksian concept of monopolistic quiet life'. We provide some evidence the sector came closer to the zero profit condition' as well as displaying a closer approximation to the law of one price' over time. We show the variability of these shadow prices' essentially coincides with that of corresponding actual prices. We utilize shadow price information to show that business models and competitive choices of banks differ across ownership types with foreign banks competing on the broadest front compared to state-owned and privately owned Turkish banks.Master Thesis Kredi ve Likidite Açısından Kobi-banka İlişki Yönetimi: İstanbul Örneği(Kadir Has Üniversitesi, 2013) Apan, Mehmet; Davutyan, NurhanBu tez calismasi ile KOB'lerin kredi ve likidite acisindan bankalarla iliskilerini nasil yonettiklerinin tespit edilmesi amaclanmistir. Bu kapsamda KOBİ-Banka ?liski Yonetimi icin “Dagitim Kanallari” “Musteri Memnuniyeti” “Kurumsallasma ve Raporlama” “Bilgi ve Uzmanlik” “?letisim Ulasilabilirlik ve İlem Hizi” “Likidite Yonetimi” “Kredinin Yapisi ve Prosedurler” ve “Bankacilik Sektorunun Yapisi ve Regulasyonlar” ana karakteristikleri tez arastirmasi ile analiz edilmistir.Master Thesis Estimating Size of Shadow Economy Through Cda: the Case of Turkey(Kadir Has Üniversitesi, 2017) Toker, Serkan; Davutyan, NurhanThis paper estimates the size of the shadow economy for the 26 NUTS-2 regions of Turkey. it is the first research that attempts at the NUTS-2 level for Turkey in the literature. The estimation used yearly data covering 2011-2014 and applies the modified currency demand approach by Ardizzi et al. (2014) with several updates. The size of the shadow economy is found as between 6.23% and 7.09% of official GDP of Turkey for the years 2011 to 2014. Results are just an indication of its base value. Because we do not have available data of cash in circulation for each NUTS-2 area we assume cash flow in circulation is approximately equal to demand deposit flow. However when the movements of the monetary aggregates variable at the country level are examined they demonstrate the similar trend. Thus this paper also present reliable distribution of the shadow economy among 26 Turkish areas. Results indicate that shadow economy has an upward trend over these specified years and the size of it in metropolitan areas like istanbul Ankara and izmir is bigger than in other areas. Also the magnitude of it is decreasing when moving from the western areas to the eastern areas of Turkey.