Tiniç, Murat

Loading...

Profile URL

Name Variants

Tinic, Murat

Tiniç,M.

Murat Tiniç

T.,Murat

TINIÇ, Murat

Murat TINIÇ

Tinic,Murat

T., Murat

Tiniç, Murat

Tinic,M.

TINIÇ, MURAT

Murat, Tinic

MURAT TINIÇ

Tiniç, M.

M. Tiniç

Tiniç, MURAT

Tiniç,M.

Murat Tiniç

T.,Murat

TINIÇ, Murat

Murat TINIÇ

Tinic,Murat

T., Murat

Tiniç, Murat

Tinic,M.

TINIÇ, MURAT

Murat, Tinic

MURAT TINIÇ

Tiniç, M.

M. Tiniç

Tiniç, MURAT

Job Title

Dr. Öğr. Üyesi

Email Address

Main Affiliation

International Trade and Finance

Status

Current Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

5

GENDER EQUALITY

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

3

Research Products

17

PARTNERSHIPS FOR THE GOALS

3

Research Products

Documents

12

Citations

70

h-index

6

Documents

13

Citations

65

Scholarly Output

10

Articles

9

Views / Downloads

69/1306

Supervised MSc Theses

0

Supervised PhD Theses

0

WoS Citation Count

35

Scopus Citation Count

41

WoS h-index

4

Scopus h-index

4

Patents

0

Projects

0

WoS Citations per Publication

3.50

Scopus Citations per Publication

4.10

Open Access Source

6

Supervised Theses

0

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| Borsa Istanbul Review | 3 |

| Applied Economics Letters | 1 |

| Economics Letters | 1 |

| Finance Research Letters | 1 |

| Fintech, Pandemic, and The Financial System: Challenges and Opportunities | 1 |

Current Page: 1 / 2

Scopus Quartile Distribution

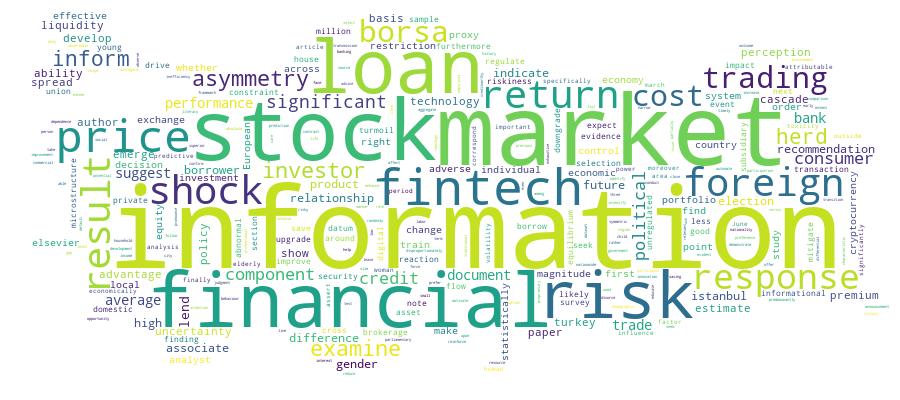

Competency Cloud

Scholarly Output Search Results

Now showing 1 - 10 of 10

Article A Note on Stock Market Response To Elections in the Post-Communist Countries of the European Union(Routledge Journals, Taylor & Francis Ltd, 2023) Tavsanli, Melike Betul; Tinic, MuratWe examine the stock market response to parliamentary elections in post-communist countries of the European Union. We document that the long-term market response to an election is -200 basis points (bps). The response is symmetric across the ideology of the winner party. Moreover, we show that aggregate responses are driven by elections with policy uncertainty due to the transition of power across ideologies. The long-term market response to right (left) victories after left (right) governments is -500 bps (-600bps).Book Part Gender Gap in Consumer Loan Performance: Evidence From Fintech Lending in an Emerging Economy(Emerald Group Publishing Ltd, 2023) Savaser, Tanseli; Tinic, Murat; Tumer-Alkan, Gunseli; Karaman, Hakki DenizThis study examines whether fintech lending further enhances or mitigates the gender-based differences in consumer loan performance in an emerging market. Using a proprietary dataset of over 5.5 million consumer loans offered by the fifth-largest bank in Turkey and its fintech subsidiary, the authors first document a significant gender gap in average loan performances. In line with the previous empirical findings, men are more likely to default on their debt. The average difference in loan performance is around 10 basis points, indicating a statistically and economically significant magnitude even after controlling for an exhaustive list of demographic and credit characteristics. Next, the authors show that the gender gap in loan performance is more pronounced in areas where women have more outside options in terms of social and economic opportunities. Specifically, the authors observe that gender-based differences are predominantly evident in cities with higher divorce rates, lower young and elderly dependence, smaller household sizes, and higher labor force participation of women. Since the child and elderly care duties disproportionately influence women's ability to participate in economic life, their ability to find resources to pay their loans in a timely manner improves more in comparison to men in areas where women face fewer restrictions to seek local economic opportunities outside the household. Finally, the authors document that fintech loans partially mitigate the gender-based differences in consumer loan performance in those cities. This result suggests that the developments in financial technology can reduce the inefficiencies associated with human involvement in credit decisions, narrowing the gender gap in loan outcomes to the extent that these gaps are attributable to the supply-side factors that involve human judgment and biases.Article Citation - WoS: 7Citation - Scopus: 12Financial Technology in Developing Economies: a Note on Digital Lending in Turkey(Elsevier Science Sa, 2021) Karaman, Hakki Deniz; Savaser, Tanseli; Tinic, Murat; Tumer-Alkan, GunseliWe examine the differences in the loan performance of fintech and bank borrowers in Turkey. Using data of 5.5 million consumer loans by the fifth-largest private commercial bank in Turkey and its fintech subsidiary, we demonstrate that fintech borrowers are on average younger, better educated, have higher income and savings levels, pay less interest and have better credit history than traditional bank borrowers. Furthermore, fintech borrowers are less likely to default. Superior performance of fintech loans is driven by the fintech firm's ability to identify creditworthy borrowers among individuals with low-credit scores. These results contrast with the earlier evidence for developed markets where fintech borrowers are found to be more risky. (C) 2021 Elsevier B.V. All rights reserved.Article Citation - WoS: 2Citation - Scopus: 2Informed Trading, Order Flow Shocks and the Cross Section of Expected Returns in Borsa Istanbul(Routledge Journals, 2020) Tiniç, Murat; Salih, AslihanThis paper examines the relationship between information asymmetry and stock returns in Borsa Istanbul. For all stocks that are traded in Borsa Istanbul between March 2005 and April 2017, we estimate the probability of informed trading (PIN) to proxy for information asymmetry.? Firm-level cross-sectional regressions indicate a statistically insignificant relationship between PIN estimates and future returns. Moreover, univariate and multivariate portfolio analyses assert that investors that hold stocks that have high information asymmetry do not obtain significant future returns. Consequently, our results suggest that information asymmetry proxied by PIN is a firm-specific risk and can be eliminated with portfolio diversification. Findings are robust to different factorizations in estimating PIN and free of any bias due to trade classification algorithms, boundary solutions, floating-point exceptions and symmetric?order flow shocks.Article Citation - WoS: 4Citation - Scopus: 4Adverse selection in cryptocurrency markets(Wiley, 2023) Tinic, Murat; Sensoy, Ahmet; Akyildirim, Erdinc; Corbet, ShaenIn this article we investigate the influence that information asymmetry may have on future volatility, liquidity, market toxicity, and returns within cryptocurrency markets. We use the adverse-selection component of the effective spread as a proxy for overall information asymmetry. Using order and trade data from the Bitfinex exchange, we first document statistically significant adverse-selection costs for major cryptocurrencies. Also, our results suggest that adverse-selection costs, on average, correspond to 10% of the estimated effective spread, indicating an economically significant impact of adverse-selection risk on transaction costs in cryptocurrency markets. Finally, we document that adverse-selection costs are important predictors of intraday volatility, liquidity, market toxicity, and returns.Article Risk Perceptions and Financial Decision Making(Elsevier, 2025) Togan, Asli; Tinic, Murat; Giray, Talha CesimWe examine whether training individuals about the riskiness of financial products changes their risk perception in making financial decisions. Conducting a nationwide survey in T & uuml;rkiye, we first map individuals' use of regulated and unregulated financial products in borrowing, saving, and investing. We next train a randomly selected sample of people in three regions where use of unregulated or risky products is high and test their financial preferences by asking them to take the survey after the training. With controls for observable characteristics, our results suggest that training on the riskiness of financial products helps improve individuals' risk perception, and this improvement seems to motivate them to prefer regulated financial products and to seeking professional advice about borrowing, saving, and investment.Article Citation - WoS: 1Citation - Scopus: 1Information Shocks and the Cross Section of Expected Returns(Elsevier, 2023) Savaser, Tanseli; Tinic, MuratThis paper examines the risk premium associated with information shocks in equity markets. For all stocks traded on Borsa Istanbul between March 2005 and December 2020, we calculate information shocks as unanticipated information asymmetry by focusing on changes in the proportion of the effective spread attributable to adverse selection. Our results indicate a significant return premium for an information shock strategy. Specifically, the return premium associated with the zero-investment information shock portfolios is 72 basis points. After controlling for several factors, we then document a significant predictive relationship between information shocks and future returns. The predictive power and the return premium associated with the information shock strategy are stronger after the initiation of the BISTECH trading system, which enables heterogeneity across investors vis-a-vis trade execution latency. These results suggest that, after the introduction of fast trading, the risks associated with information shocks become systemically important in the cost of equity.Copyright & COPY; 2022 Borsa Istanbul Anonim S,irketi. Published by Elsevier B.V. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/).Article Citation - WoS: 6Citation - Scopus: 7Who To Trust? Reactions To Analyst Recommendations of Domestic Versus Foreign Brokerage Houses in a Developing Stock Market(Elsevier Ltd, 2021) Tanyeri, Başak; Bodur, Mehmet; Tiniç, MuratAnnouncement day abnormal returns around analyst recommendations of upgrades average 35 and downgrades average -45 basis points in Borsa Istanbul. The nationality of the investment bank issuing the recommendation affects the magnitude of the stock market reaction. The absolute magnitude of abnormal returns upon upgrade and downgrade recommendations of foreign investment banks is larger than that of local investment banks. The differential reaction indicates that in a developing market country, Turkey, investors pay closer attention when the source of information is foreign rather than local.Article Citation - WoS: 6Citation - Scopus: 6Political Turmoil and the Impact of Foreign Orders on Equity Prices(Elsevier, 2020) Tiniç, Murat; Savaşer, TanseliThis paper examines whether foreign investors possess an information advantage over local investors in the Turkish stock market between 2007 and 2015. We find that foreign investors have an information advantage in 24 stocks, corresponding to seven percent of the sample firms. Foreign investors' information advantage tends to prevail primarily during a period of political instability, which started with the Gezi Park protests in June 2013. The adverse selection component of the foreign trade spreads, which reflects a permanent change in stock prices, rises significantly after June 2013, by 66 bps. Our results suggest that domestic investors' funding constraints, which limit their ability to impart their information on stock prices, may give foreign investors a relative information advantage during periods of political turmoil. (C) 2020 Elsevier B.V. All rights reserved.Article Citation - WoS: 9Citation - Scopus: 9Information Cascades, Short-Selling Constraints, and Herding in Equity Markets(Borsa İstanbul Anonim Şirketi, 2020) Tiniç, Murat; Iqbal, Muhammad Sabeeh; Mahmud, Syed F.This paper examines the relationship between informed trading and herding in Borsa İstanbul. Our firm-level cross-sectional analysis asserts that informed trading can significantly increase future herding levels. Furthermore, we show that the relationship between informed trading and herding intensifies under short-selling restrictions. Our results confirm the predictions of the informational cascades framework where the individuals disregard their private information to follow others. We show that information cascades are relevant both for buy-side herding and sell-side herding. Short-selling restrictions may reinforce the herding behaviour since informed investors may not be able to clear out potential price misalignments.