This item is non-discoverable

Selçuk, Elif Akben

Loading...

Profile URL

Name Variants

Selçuk, Elif Akben

E.,Selçuk

E. A. Selçuk

Elif Akben, Selçuk

Selcuk, Elif Akben

E.,Selcuk

E. A. Selcuk

Elif Akben, Selcuk

Akben Selçuk, Elif

Akben Selçuk, Elif

Akben-Selcuk, Elif

Akben-Selcuk, Elif

E.,Selçuk

E. A. Selçuk

Elif Akben, Selçuk

Selcuk, Elif Akben

E.,Selcuk

E. A. Selcuk

Elif Akben, Selcuk

Akben Selçuk, Elif

Akben Selçuk, Elif

Akben-Selcuk, Elif

Akben-Selcuk, Elif

Job Title

Doç. Dr.

Email Address

Main Affiliation

Business Administration

Status

Former Staff

Website

ORCID ID

Scopus Author ID

Turkish CoHE Profile ID

Google Scholar ID

WoS Researcher ID

Sustainable Development Goals

1

NO POVERTY

3

Research Products

4

QUALITY EDUCATION

1

Research Products

8

DECENT WORK AND ECONOMIC GROWTH

3

Research Products

16

PEACE, JUSTICE AND STRONG INSTITUTIONS

1

Research Products

17

PARTNERSHIPS FOR THE GOALS

1

Research Products

This researcher does not have a Scopus ID.

This researcher does not have a WoS ID.

Scholarly Output

21

Articles

17

Views / Downloads

159/3246

Supervised MSc Theses

2

Supervised PhD Theses

0

WoS Citation Count

286

Scopus Citation Count

342

WoS h-index

7

Scopus h-index

7

Patents

0

Projects

0

WoS Citations per Publication

13.62

Scopus Citations per Publication

16.29

Open Access Source

12

Supervised Theses

2

Google Analytics Visitor Traffic

| Journal | Count |

|---|---|

| Sustainability | 2 |

| Finans Politik ve Ekonomik Yorumlar Dergisi | 1 |

| International Journal of Bank Marketing | 1 |

| International Journal of Economic Sciences | 1 |

| International Journal of Emerging Markets | 1 |

Current Page: 1 / 2

Scopus Quartile Distribution

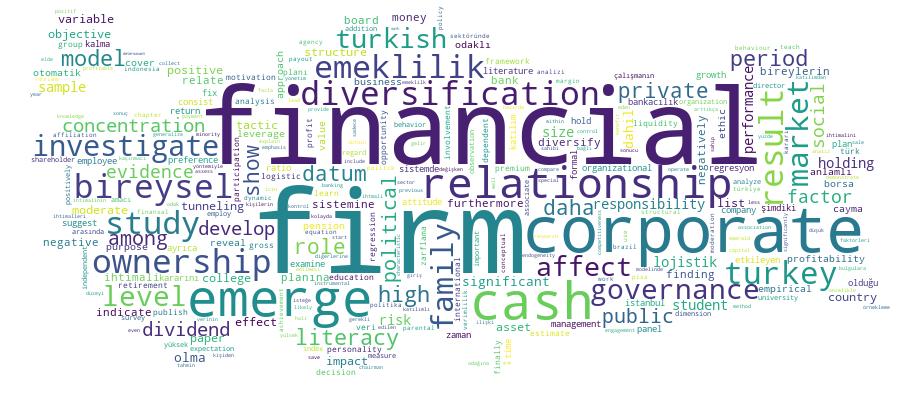

Competency Cloud

Scholarly Output Search Results

Now showing 1 - 10 of 21

Book Part Citation - WoS: 5Citation - Scopus: 6Determinants of Corporate Cash Holdings: Firm Level Evidence From Emerging Markets(Springer, 2017) Akben Selçuk, Elif; Altiok-Yilmaz, AyseThe objective of this chapter is to investigate the factors affecting corporate cash holdings in five emerging markets namely Brazil Indonesia Mexico Russia and Turkey. The sample consists of 1991 firms listed on the major stock exchange of their countries and covers the period between 2009 and 2015. The model is estimated by Arellano–Bond dynamic generalized method of moments. Results show that firms which use higher leverage in their capital structure hold more cash. More profitable firms are shown to have higher levels of cash holdings. Another variable which has a positive effect on the level of cash holdings in any given period is the level of cash holdings in the previous period as shown by the positive and significant coefficient of the lagged dependent variable in the model. Liquidity and firm size have a negative and statistically significant impact on the level of corporate cash holdings. Firms with higher level of capital expenditures are also shown to hold less cash. Finally growth opportunities do not have a significant impact on the level of cash holdings for the firms in the emerging markets analyzed. © Springer International Publishing AG 2017.Article Citation - WoS: 12Citation - Scopus: 14Family Involvement, Corporate Governance and Dividends in Turkey(Emerald Group Publishing Limited, 2019) Sener, Pinar; Akben Selçuk, ElifPurpose: The purpose of this paper is to investigate the relationship between dividends and family involvement as well as corporate governance characteristics among Turkish public firms. Design/methodology/approach: Using panel data on Turkish firms listed on the Borsa Istanbul 100 index for 2006–2014 three models are estimated. For the first two models where the dependent variables are the dividend payout ratio and dividend yield respectively tobit regressions are run. The last model which employs a dividend dummy as the dependent variable is estimated with logistic regression. Findings: There is a positive and concave relationship between family ownership and dividends. The existence of a family chairman reduces dividends. There is a positive association between board size and dividends and this relationship is weaker for firms with higher levels of family ownership. Finally the ratio of independent directors on the board is negatively associated with dividends. Practical implications: The findings imply that firms with substantial family ownership and active family participation in management are more likely to send a negative signal to minority shareholders by paying lower dividends. In addition minority shareholders should pay attention to the board structure of firms in which they invest. Originality/value: This study is one of the few to analyze the nonlinear relationship between family ownership and dividend payments as well as the role of family management in a developing country. Second it investigates the role of board characteristics in explaining dividend payment decisions. © 2019 Emerald Publishing Limited.Article Citation - Scopus: 129Corporate Social Responsibility and Financial Performance: the Moderating Role of Ownership Concentration in Turkey(MDPI, 2019) Akben Selçuk, ElifThe objective of this study is to investigate the impact of corporate social responsibility (CSR) engagement on firm financial performance in a developing country, Turkey, and to analyze the moderating role of ownership concentration in the CSR-financial performance relationship. The sample consists of non-financial public firms listed on the Borsa Istanbul (BIST)-100 index and covers the period between 2014 and 2018. Empirical results using an instrumental variable approach show that corporate social responsibility has a positive relationship with financial performance. Furthermore, findings indicate that this relationship is negatively moderated by ownership concentration even when endogeneity is controlled for.Article BİRLEŞME VE SATIN ALMA İŞLEMLERİNİN ŞİRKET VE SEKTÖR DÜZEYİNDE ETKİLERİ(2016) Akben Selçuk, Elif; Köksal, Emin; Altıok Yılmaz, Ayşe Dilara[Abstract Not Available]Article Citation - WoS: 91Corporate Social Responsibility and Financial Performance: The Moderating Role of Ownership Concentration in Turkey(Mdpi, 2019) Akben-Selcuk, ElifThe objective of this study is to investigate the impact of corporate social responsibility (CSR) engagement on firm financial performance in a developing country, Turkey, and to analyze the moderating role of ownership concentration in the CSR-financial performance relationship. The sample consists of non-financial public firms listed on the Borsa Istanbul (BIST)-100 index and covers the period between 2014 and 2018. Empirical results using an instrumental variable approach show that corporate social responsibility has a positive relationship with financial performance. Furthermore, findings indicate that this relationship is negatively moderated by ownership concentration even when endogeneity is controlled for.Article Türkiye'de Bireysel Emeklilik Sistemine Katılım Kararını Etkileyen Faktörler(2017) Selçuk, Elif Akben; Aydın, Aslı ElifBu çalışmanın amacı, Türkiye'de bireysel emeklilik sistemine giriş ve otomatik katılımdan cayma kararını etkileyen faktörleri ortaya koymaktır. 130 kişiden kolayda örnekleme ile elde edilen verinin lojistik regresyon yöntemiyle analiz edilmesi sonucu şu bulgulara ulaşılmıştır: Öncelikle, yaş ve gelir düzeyi arttıkça bir bireysel emeklilik planına dahil olma ihtmali artmaktadır. Şimdiki zaman odaklı olan bireylerin bir bireysel emeklilik planına dahil olma ihtimali daha düşük bulunmuştur. Ayrıca, iç kontrol odağına sahip kişilerin bireysel emeklilik planına dahil olma ihtimalleri daha yülsek bulunmuştur. Son olarak, kaçınmacı odak ve bireysel emeklilk sistemine dahil olma ihtimali arasında pozitif ve anlamlı bir ilişki olduğu görülmektedir. Otomatik katılımlı sistemde kalma ihtimalini tahmin eden lojistik regresyon modelinde ise sadece iki değişken anlamlı sonuç vermiştir. Şimdiki zaman odaklı bireylerin cayma ihtimalinin daha yüksek olduğu görülmektedir. Ayrıca hali hazırda isteğe bağlı bir bireysel emeklilik planı sahibi olan bireylerin sistemde kalma ihtimali diğerlerine göre 2.9 kat daha fazla bulunmuştur.Master Thesis A Study on the Political Tactics Used in Business Environments by the Employees Working in Private Banks and Public Banks(Kadir Has Üniversitesi, 2017) Yumus, Seda; Akben Selçuk, ElifThe Use of Political Tactics in Organizations has been the subject of many researches in different fields and a lot of information has been obtained about organizational structures and human behaviors in these structures. in academic literature it has been seen that The Use of Political Tactics in Organizations has not been studied regarding the banking sector which is a large institutional and organizational structure and this research has provided a basis for examining the observations and expectations of employees of private and public banks about the Use of Political Tactics. As a result of the scale applications data showing the attitudes of the employees in private and the public banks regarding the use of political tactics in the organizations were obtained and these data were examined by measuring the observations and expectations about the use of political tactics thus leading to the conclusion that the observations and expectations of employees of both public and private banks do differ. Through this work various arrangements can be made in the banking sector which is an example of organizational structure based on reasons ratios and consequences of using political tactics among private and public bank employees.Book Part Citation - Scopus: 3Cash Holdings and Corporate Governance: Evidence From Turkey(IGI Global, 2019) Akben Selçuk, Elif; Şener, PınarThis chapter investigates the empirical factors affecting corporate cash holdings with special emphasis on corporate governance variables for a sample of Turkish-listed nonfinancial firms over the period 2006 to 2010. The findings reveal a significant non-linear relation between family ownership and cash holdings. In addition, while board structure does not significantly affect the level of cash holdings, tunneling increases cash reserves of firms. Furthermore, the results indicate that cash flow, leverage, other liquid assets that can be used as cash substitutes, the degree of tangibility of assets, and firm size are important in determining cash holdings among Turkish companies.Article Citation - WoS: 12Citation - Scopus: 17Corporate Diversification and Firm Value: Evidence From Emerging Markets(Emerald Group Publishing Limited, 2015) Akben Selçuk, ElifPurpose - The purpose of this paper is to investigate the impact of corporate diversification on firm value in a sample of nine emerging markets including Brazil Chile Indonesia Malaysia Philippines Poland South Africa Thailand and Turkey. For the purpose of this study a company is classified as diversified when it is operating in two or more lines of business defined by the two-digit SIC codes. Design/methodology/approach - Employing panel data from 1568 companies for the period 2005-2010 this paper estimates both a fixed effects model and a dynamic generalized method of moments model. Data are collected both at company level and segment level within each firm. Findings - Overall analysis results suggest that for the period from 2005 to 2010 diversified firms in emerging markets are valued more compared to single-segment firms operating in similar industries providing support for diversification premium. Originality/value - The effect of diversification on company value in emerging markets is an important managerial and public policy concern. Although the literature on developed country diversified firms is rich only a few studies have examined diversification-value relationship in the context of developing countries. Furthermore most previous research on the value effects of corporate diversification in emerging markets has taken the form of case studies within countries and concentrated on the 1990s. This paper tries to fill these gaps by using a larger sample and more recent data and methodology.Master Thesis Lojistik İşletmesinde Risk Odaklı Bir Yönetim(Kadir Has Üniversitesi, 2013) Kaba, Nilay; Akben Selçuk, Elifcalismanin sonucunda ulasilan nokta Horoz Lojistik hasarli urun ve gec teslimat riskleri icin gerekli risk yonetim modelleri riski bir sigorta sozlesmesiyle paylasmak performans yonetiminin uygulanmasi bilgi yonetimi icin gerekli teknolojik altyapinin (RFiD Barkod ve Arac Takip Sistemlerinin) saglanmasi ve en onemlisi risk yonetim kulturunun isletmenin tum bolumlerinde benimsenmesinin saglanmasidir.

- «

- 1 (current)

- 2

- 3

- »